We are a concessions company of Grupo Argos dedicated to the structuring, promotion, development, management and investment in road and airport infrastructure with projects that contribute to competitiveness, connectivity and the generation of opportunities in the regions.

We are managers of a complete portfolio of assets through a Private Equity Fund with two investment platforms in infrastructure: Odinsa Vías and Odinsa Aeropuertos; established in conjunction with Macquarie Asset Management (MAM), the largest infrastructure asset manager in the world.

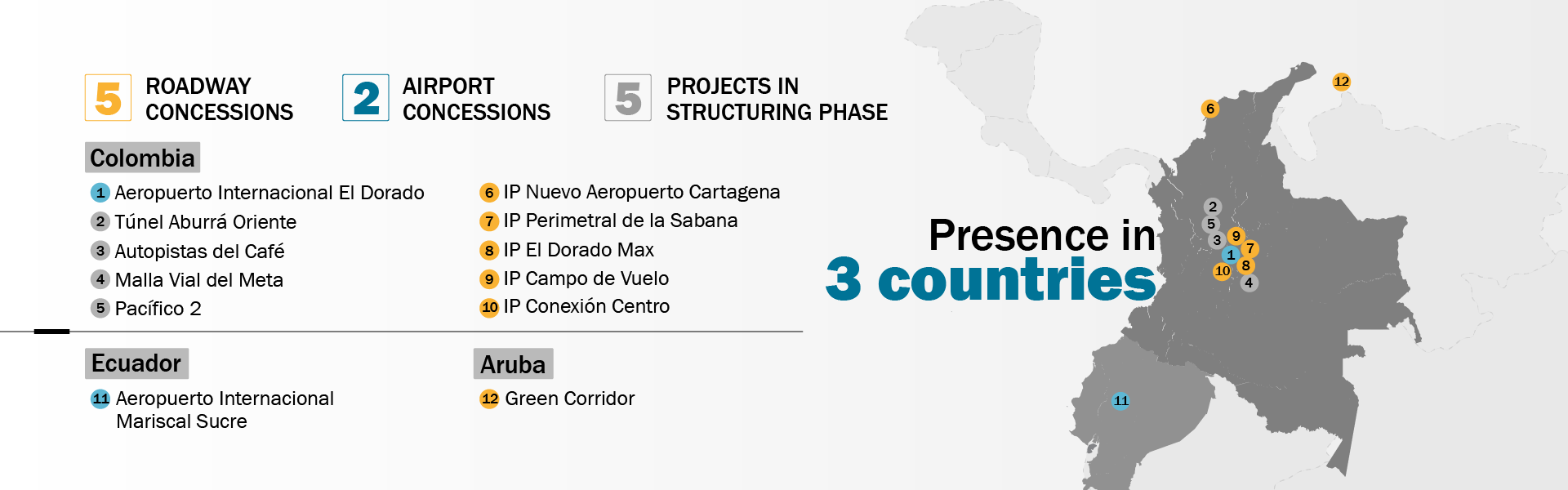

We have presence in Colombia, Ecuador and Aruba with five (5) road projects and two airport projects. In addition, we have five (5) Private Initiatives with which we seek to contribute to the progress of the territories and anticipate their needs by providing solutions.

Together with our valuable team, we work with commitment and conviction to contribute to competitiveness, having sustainability as a fundamental pillar; for us, more than a purpose, represents a journey of transformation open to all, inspiring and shared, in which we seek to create a conscious route to the future hand in hand with our stakeholders.

Odinsa was founded by construction and engineering companies.

Awarding of the first road concessions to ODINSA.

Issuance of ordinary bonds for COP 280,000 million.

Systems Engineer from Universidad Eafit, he completed the Top Executives Program at Universidad de los Andes. He has served as Adjunct Professor at Eafit and Rosario Universities.

He has more than 35 years of experience in different sectors, leading companies such as Invamer-Gallup Colombia, General Manager; Grupo EMP, General Director and CEO; and recently he was in charge of the Colombian Embassy in Canada. In addition, he has extensive experience as a member of the Board of Directors of different companies in different sectors, including food, telecommunications and innovation, and in the academic world.

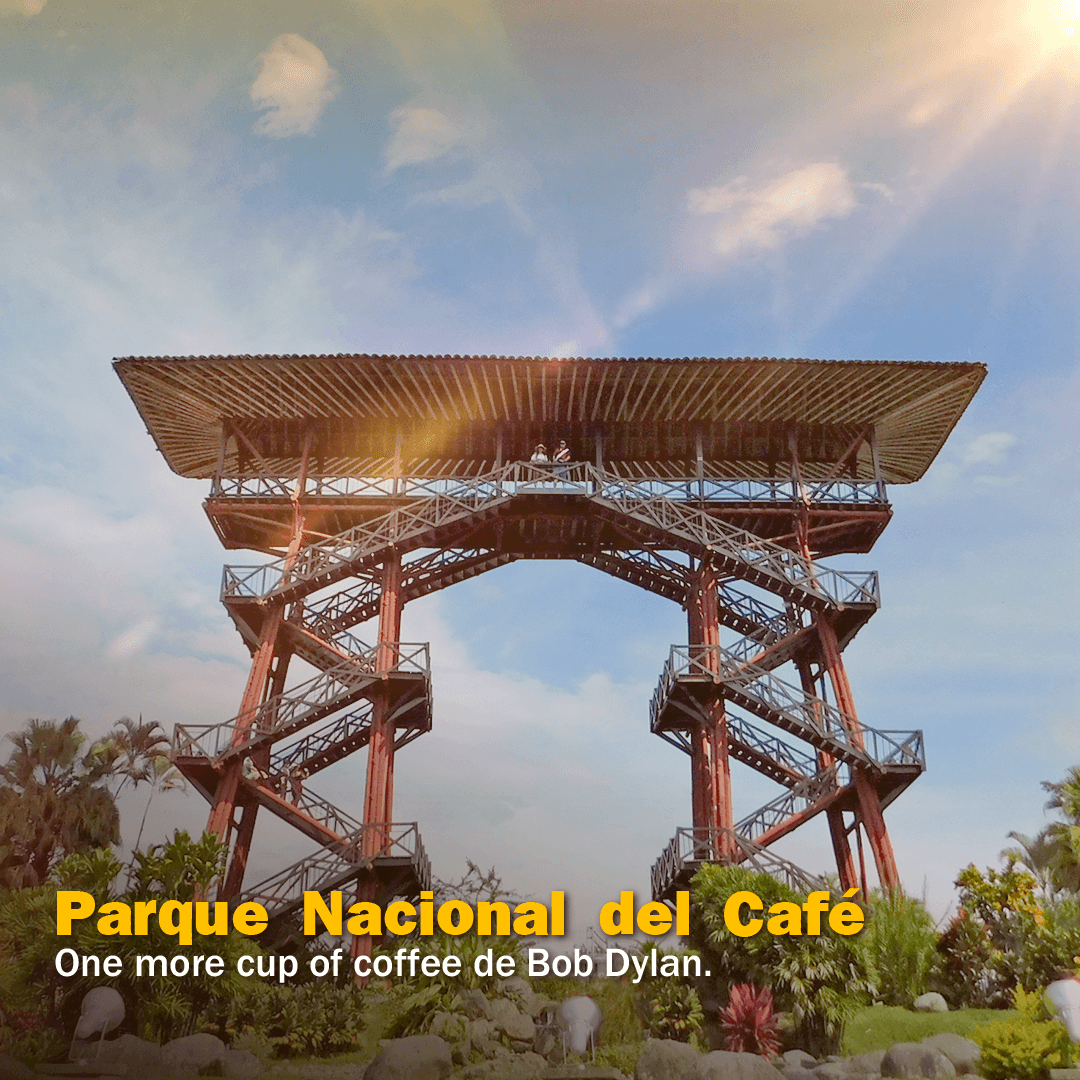

Llegó la temporada de vacaciones y con ella el momento de disfrutar nuestro país!

#OdinsaTeReconecta.

A través de nuestras concesiones puedes llegar a lugares mágicos de nuestra geografía.

Te invitamos a que recorras el país por nuestras vías y aeropuertos.

#Reconéctate con hermosos lugares de Colombia y nuevos amaneceres.

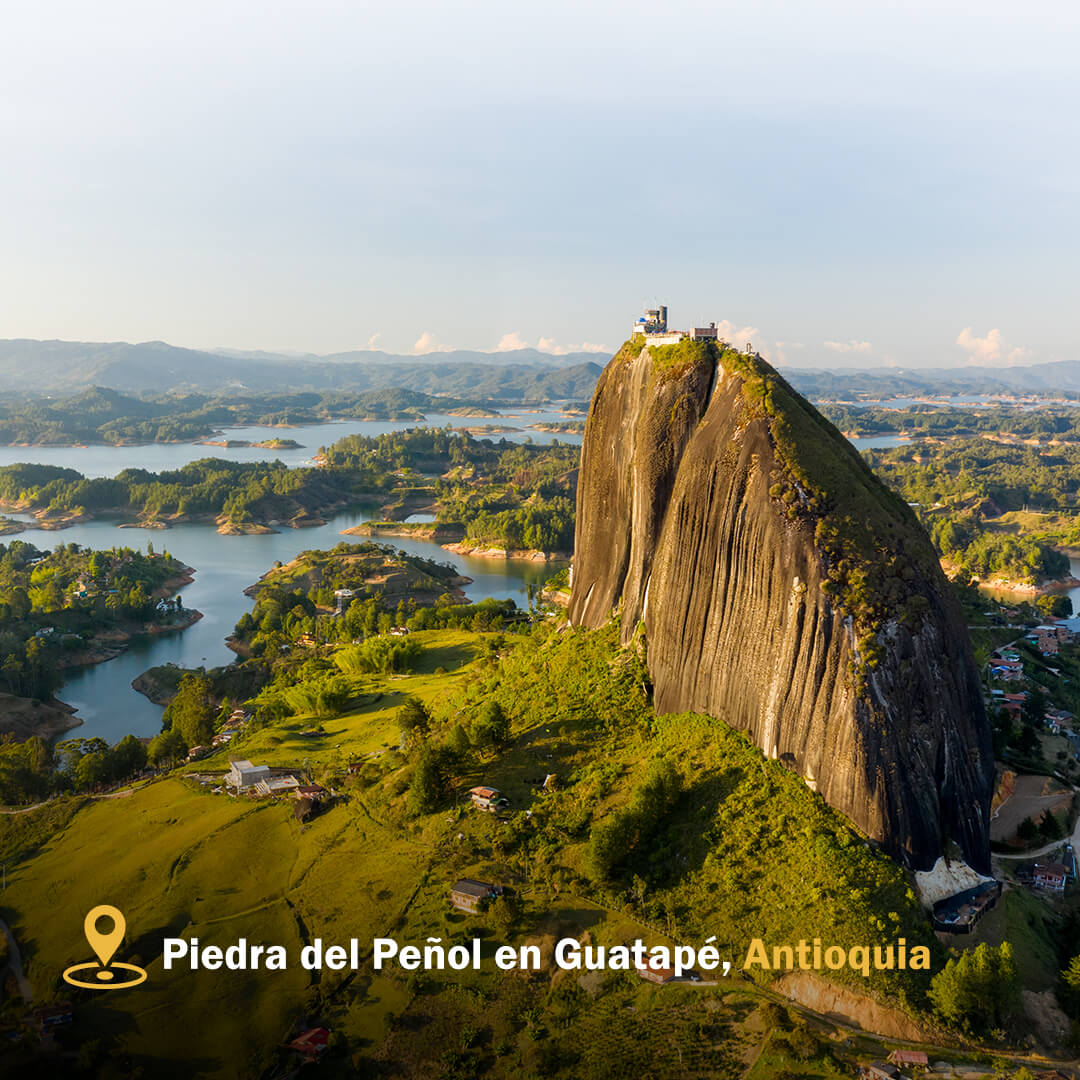

#ReconéctateConColombia 🇨🇴. Si vas a visitar la ciudad de la eterna primavera estos son algunos destinos que Medellín y sus alrededores tienen para ti.

#OdinsaTeReconecta con el Aeropuerto Internacional El Dorado. Visita destinos

mágicos acompañado de tu familia para que vivas momentos increíbles.

Paisajes Malla Vial del Meta

#OdinsaTeReconecta

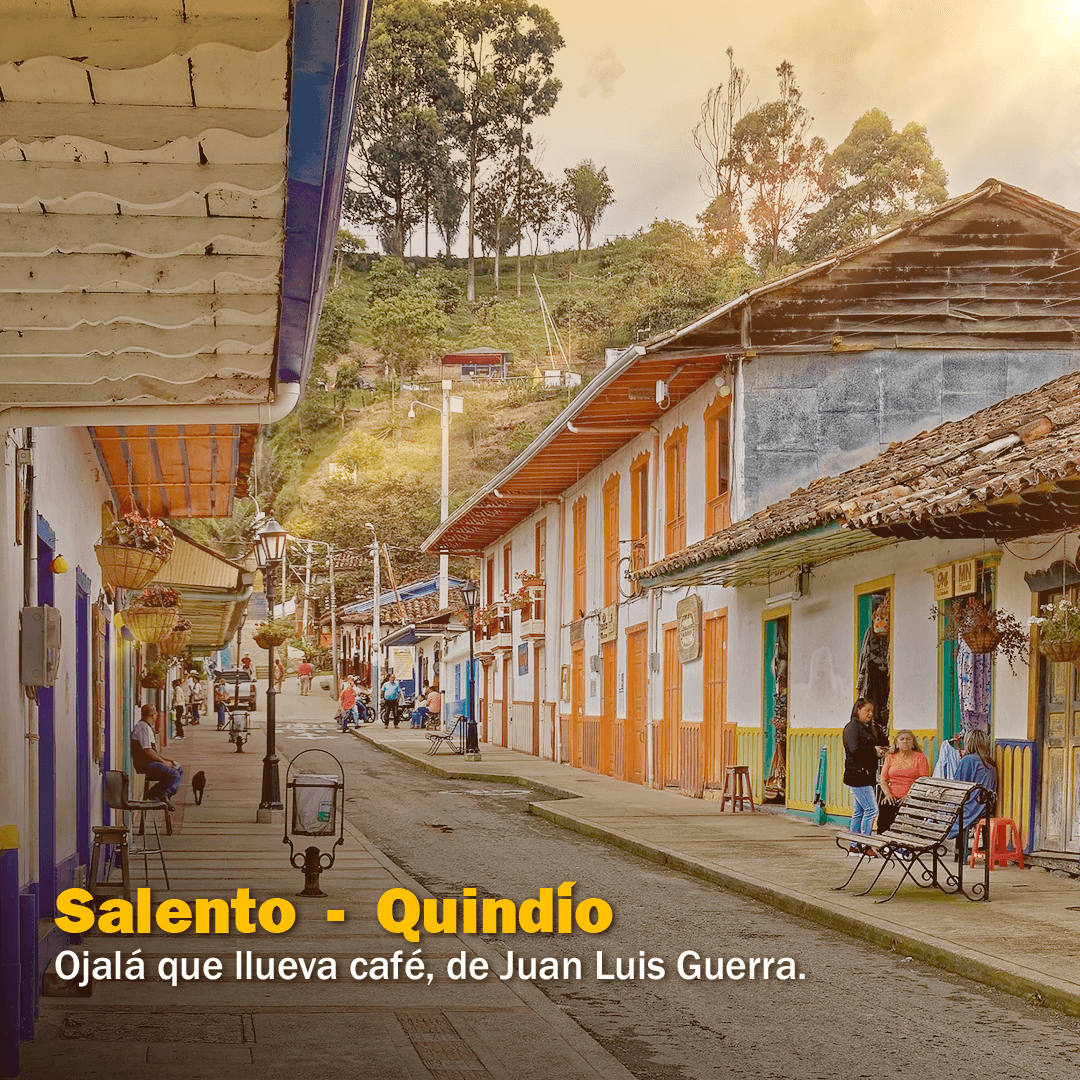

Despierta los sentidos con la música, los paisajes y sabores con los que cada una de nuestras concesiones nos invitan a reconectarnos.

Dale una mirada y comparte aquí

Start date as member of the Board of Directors:

Studies

Experience

Outstanding competences

Supporting Committees

Member of Boards of Directors of:

Casa Editorial El Tiempo, Fondo de Pensiones Protección, Cadena.

Starting date as member of the Board of Directors:

Studies

Experience

Outstanding competencies

Supporting Committees

Member of Boards of Directors of:

Celsia, Libertank Board of Directors, Mesa Temática Empresas y Valor Social de Proantioquia, Board of Directors of the Medellin Regional of Endeavor.

Starting date as a member of the Board of Directors:

Studies

Experience

Outstanding competencies.

Support Committees

Member of Boards of Directors of:

Cementos Argos, Celsia, ANDI Seccional Antioquia.

Start date as member of the Board of Directors:

Studies

Experience

Outstanding Competencies

Support Committees

Member of Boards of Directors of:

Cementos Argos, Celsia, Pactia Investment Committee, Aceros Mapa S.A., Corporación Surgir, member of Iluma (Premex S.A.S.) and of the Superior Council of Universidad EIA.

Start date as member of the Board of Directors:

Studies

Experience

Outstanding competencies

Supporting Committees

Member of Boards of Directors of:

Grupo Sura, Cementos Argos, Celsia, Summit Materials USA, Grupo Argos Foundation, Proantioquia and the Superior Council of EIA University.